Two clocks are ticking in Big Canoe.

One is long‑term—the push for a full forensic audit that could take months of document pulls and CPA fieldwork. The other is immediate: the primary election only weeks away, where block voting will decide which four names advance to the November ballot—and, quite possibly, whether the current leadership circle stays intact.

This first report in our forensic series focuses on a sharp, unexplained spike in payroll head‑count—357 employees in 2022 to 503 in 2023—without a proportionate rise in cash wages. On its face that’s a bookkeeping red flag, but it also expands the pool of “employee property owners” who can vote. Add in a ballot that lets each voter mark up to four names in a six‑candidate primary, and you have a system where a well‑coached staff bloc can knock independent voices off the final ballot by fewer than ten votes. (See our 2 Page A.I. Analysis on how the Primary Vote may be rigged).

The data below shows serious Financial Discrepancies, but also provides a blueprint for how a “Deep State” voting block may have been developed.

🔍 Pre-Forensic Addendum: Employee Count and Payroll Discrepancy (2023)

This document will be used to supplement the main preliminary pre-forensic audit report (currently in Draft) and focuses on a significant inconsistency found in POA labor reporting as disclosed in:

- 2022 & 2023 IRS Form 990s

- 2022 % 2023 Measures & Tracking Reports (M&T)

- 2022 & 2023 Audits and Owner Financial Statements

I. 📈 Summary of Key Metrics

| Year | Employees (IRS 990) | Total Payroll | Avg. Pay per Employee | % Change in Employees | % Change in Payroll | % Change in Avg. Pay |

|---|---|---|---|---|---|---|

| 2022 | 357 | $8.90M | $24,926 | — | — | — |

| 2023 | 503 | $9.59M | $19,068 | +40.9% | +7.78% | –23.5% |

(Note: IRS “Employees” = total individuals on the W‑3; not FTEs. Internal FTE counts in M&T are ~160.)

† Cash payroll only?. Might not include the value of any in‑kind fringe benefits (free golf, meals, amenity passes). If those perks substitute for wages, the true average compensation gap is even larger than shown.

II. 🔎 Forensic Concerns

1. ❌ Disproportionate Payroll-to-Headcount Growth

- Employees increased by 40.9%, but payroll rose only 7.78%, resulting in a 23.5% drop in average compensation. This is is statistically anomalous. Unless there were significant wage reductions, it indicates possible data misreporting or inconsistent job classifications.

- No documentation in IRS filings, audits, or internal reports explains any large-scale wage reductions.

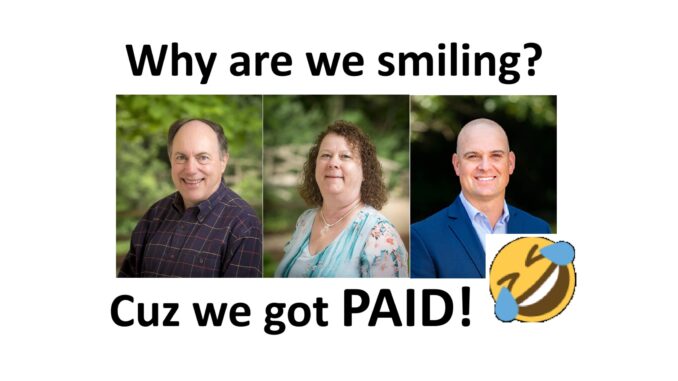

- During the same time that Employee average compensation dropped 23.5%, the top 3 management position salaries* increased substantially (per IRS 990s):

-

- Scott Auer $238,476 (2022) –> $264,325* (2023) ^10.9%

- Jayne Hagan $120,975 (2022) –> $140,574* (2023) ^16.2%

- Lydell Mack $114,955 (2022) –> $127,216* (2023) ^10.7%

- * Salaries also do not reflect substantial “additional compensation“.

(Auer: add^$25,575 ; Hagan: add^$18,045 ; Mack: add^$22,902 )

-

- One plausible driver is a “low‑cash/high‑perk” pay model: paying rock‑bottom wages while compensating with free amenities that never hit the payroll ledger.

2. ⚡️ Conflicting Internal Reports

- 2023 M&T reports show

- (a) Staffing overruns in F&B and Public Safety, and

- (b) Continued high overtime.

* These conflict with a 23.5% drop in average per-employee costs

3. ⚠️ IRS Form 990 Compliance Risk & Exposure

- Part I, Line 5 (total employees) must be consistent with Part V, line 2a (W‑3 count) and logically reconcile to payroll totals in Part IX. Part VII (officer/ key employee comp) is a different disclosure, but glaring inconsistencies across sections attract IRS scrutiny.

- The data suggests either:

- Misclassified workers (e.g., seasonal or part-time labeled as full-time)

- Incomplete payroll reporting or contractor omission

- Inaccurate employee counts or incomplete compensation disclosure can trigger penalties under IRC §6652 and jeopardize exemption compliance. Expect the IRS TE/GE division to ask for payroll registers, W‑3/W‑2 tie‑outs, and contractor lists.

4. 🔧 GAAP & Internal Control Issues

- Accrual accounting requires wage expenses to reflect earned compensation.

- Any deferred comp, unpaid bonuses, or contractor masking would violate GAAP.

- Failing to value in‑kind perks at FMV and include them in wages violates GAAP (ASC 718/ASC 840) and IRS fringe‑benefit rules (Reg. §1.61‑21).

- GAAP/Financial Statement Integrity: If audits didn’t test the linkage between HR systems and reported payroll, internal control deficiencies (material weakness or significant deficiency) may exist.

5. 🔒 Misclassification or Under‑Reporting Risk

Potential drivers to test:

-

Low‑cash / high‑perk hiring strategy. POA may have bulk‑hired property‑owner members at minimal hourly wages while compensating them with in‑kind perks—free golf, fitness passes, dining credits, or clubhouse meal allowances. If those fringe benefits are not grossed‑up as taxable wages or booked in “employee benefits,” payroll totals stay artificially low while headcount soars.

-

Deferred, off‑ledger, or capitalized pay. Unrecorded bonuses, deferred comp, or labor costs buried in capital projects can further understate Form 990 Part I/IX figures.

Why this matters:

-

Unreported perks = under‑withheld payroll taxes and Form 990 understatement.

-

Perks tied to club amenities may need to be allocated as Unrelated Business Income (UBI) expenses under IRC §512; failing to do so risks IRS penalties.

-

Hiring owners at below‑market cash wages but rich perks may constitute private benefit/private inurement, jeopardising 501(c)(4) status.

- If unreported perks are tied to commercial amenities (golf, dining, etc.), the cost allocation also affects Unrelated Business Income calculations on Form 990‑T.

6. ⚡️ GA Nonprofit Code Exposure

- Members can demand books and records “reasonably related” to their interests (§14‑3‑1602). Failure to provide can lead to court-ordered inspection and attorney’s fees for the requesting member(s).

- Systematic under‑reporting of compensation or private inurement through below‑market cash wages plus exclusive perks can trigger administrative dissolution for operating outside nonprofit purposes (O.C.G.A. §14‑3‑140).

III. 🤝 Plain‑Language Action Plan for Property Owners

(Think of this as a short how‑to guide. Follow the steps in order; none require accounting jargon.)

-

Ask for the basic payroll list — in writing.

-

- Send the POA Office an email or certified letter:

“Please provide the 2022–2023 employee roster (names can be redacted to last 4 digits of SSN), each worker’s start/stop dates, status (full‑time, part‑time, or seasonal), and total cash wages and perks.” - Quote Georgia law: O.C.G.A. §14‑3‑1602 (your legal right to see those records).

- Send the POA Office an email or certified letter:

-

Match dollars to people (the “2‑column test”).

-

- Column A: add up all wages + benefits on the roster.

- Column B: check the same totals on Form 990 Part IX and in the M&T “Overall Payroll” line.

- If A ≠ B, ask “Where’s the difference?”

-

Spot the “cheap‑cash / rich‑perks” deals.

-

- Look for anyone paid far below minimum wage but shown with big free‑amenity values (golf passes, comp meals).

- If perks aren’t listed at all, flag that as “Missing fringe benefits.”

-

Escalate only if stonewalled.

-

- No records after 30 days? File IRS Form 13909 and copy the GA Secretary of State.

- Attach the unanswered request letter and any partial responses.

- Tell the Board you’ve escalated — regulators often act faster when owners show a paper trail.

-

Push for an independent forensic audit — with teeth.

-

- Insist on an engagement letter that:

- gives auditors direct access to payroll and amenity‑usage logs,

- lets them report straight to the membership, and

- requires the Board to publish the full findings within 30 days.

- Insist on an engagement letter that:

-

Keep it simple, keep it civil.

-

- You don’t need to be a CPA. Just track: Heads → Dollars → Documents.

- The numbers will tell the story; your job is making sure they see daylight.

Follow these steps and you’ll either get clear answers or build a solid case for outside action. One way or another, the truth comes out.

✅ Summary

This labor data discrepancy raises serious compliance, governance, and accounting concerns. It warrants:

- Further investigation into internal controls and wage classification

- Formal response from the POA accounting and HR teams

- Immediate transparency with owners and regulators

Bottom line: Members fund this operation; regulators police it. Act accordingly – this inconsistency should be treated as a high-priority audit target within any third-party forensic investigation.

Beyond balancing the books, owners should also understand the power dynamics hidden in these numbers. Fixing the math is urgent; understanding why the math went wrong may be even more critical. This article, and our last article “Allegations of Election & Social Media Interference by Big Canoe POA Communications Director” are foundational to upcoming “Deep State” Articles.

Be the first to comment